Equine Industries We Serve

From breeding operations to boarding facilities, farriers to feed stores — Phoenix Accounting understands the unique financial needs of the equestrian world. We serve horse industry professionals nationwide with specialized accounting expertise.

Equestrian Sectors We Specialize In

Each segment of the horse industry has unique accounting challenges. Our team brings deep expertise to every equine business we serve.

Farms / Stables

Accurate cost tracking for feed, maintenance, and operations.

Lesson Programs

Manage lesson revenue, expenses, and deductions seamlessly.

Breeding Operations

Specialized handling of breeding costs, depreciation, and sales.

Equine Hauling Companies

Track fuel, maintenance, and transport-specific expenses.

Farriers / Blacksmiths

Simplify invoicing, supplies, and mobile service tracking.

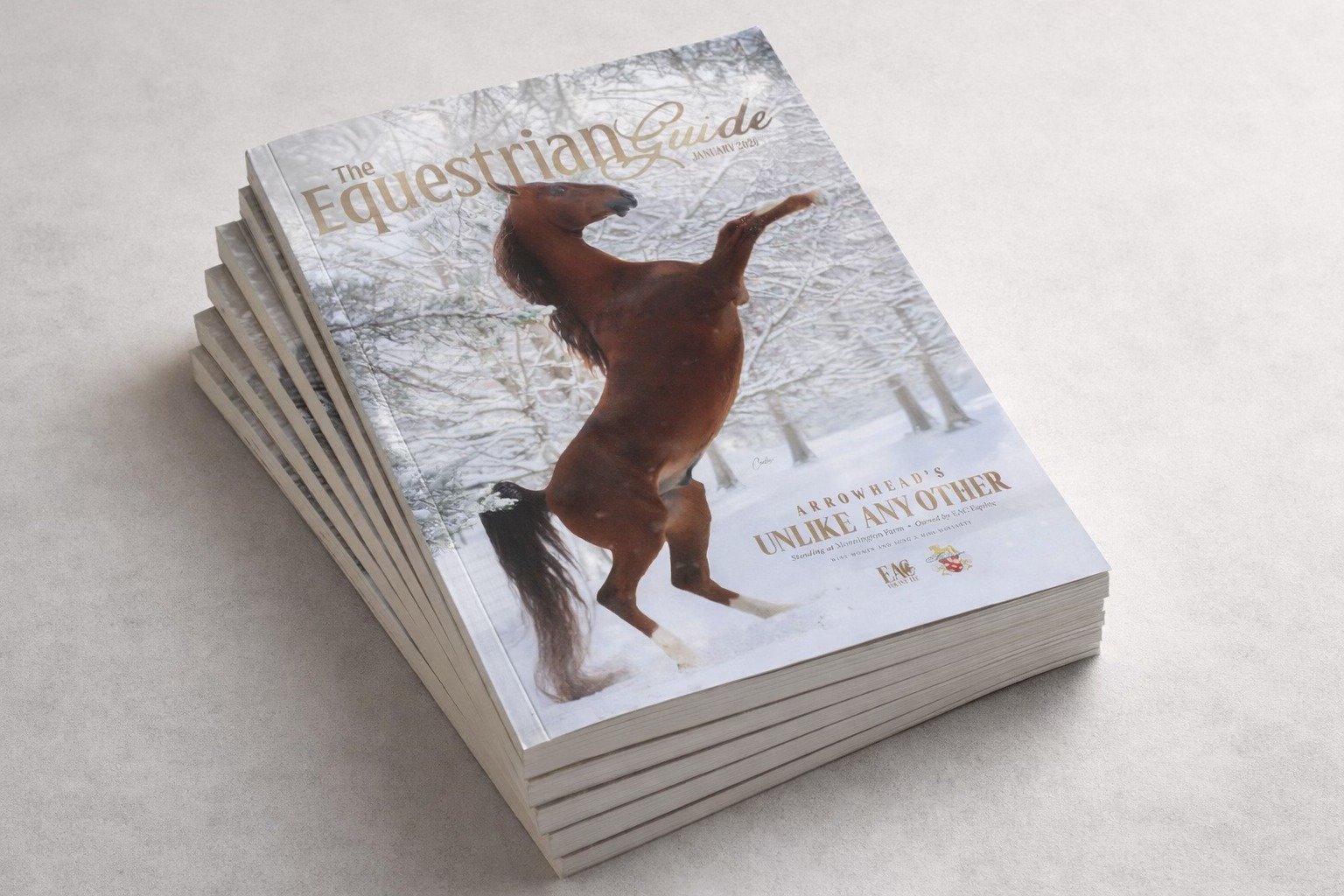

Equestrian Magazines

Manage subscriptions, advertising revenue, and publishing costs.

Farm & Feed Stores

Inventory, sales tax, and retail accounting expertise.

Equine Photographers

Deductions for equipment, travel, and creative expenses.

Boarding Facilities

Monthly billing, facility costs, and compliance tracking.

Equine Investments

Financial reporting and investment-specific analysis.

Veterinarians

Handle medical supply costs, client invoicing, and professional deductions.

Tack Companies

Retail sales, inventory, and wholesale accounting.

Why Choose Phoenix Accounting for Your Equine Business

The same way you wouldn't trust your champion horse to just any vet, don't trust your finances to just any accountant.

A Unique Background✨

Winning History★

Your Ticket to Success🎯

Equine Service Packages – Scalable for Your Operation

Choose the perfect package that grows with your equine business

Bronze

Up to 75 transactions/month

Silver

Up to 150 transactions/month

Gold

Up to 300 transactions/month

Platinum

Up to 500 transactions/month

One-time setup and onboarding fee applies to all new bookkeeping clients.

Customize with Powerful Add-Ons

Sales & Use Tax Reporting

Nationwide compliance

Strategic Tax Planning

Maximize deductions legally

Business Consulting

Growth strategy sessions

Business Formation

LLC, S-Corp, Partnerships

1099 Filings

Contractor compliance

Insurance Audit Assistance

Liability protection

Managed Annual Report

State filings handled

Payroll Processing

Full payroll processing

BOI Reporting

Beneficial ownership filings

Bill Payment Services

Vendor management

S-Corp Election

Tax structure optimization

Payroll Setup in QBO

QuickBooks integration

Monthly Client Invoicing

QBO invoice automation

4 Simple Steps

From first contact to financial clarity

Request Quote

Fill out our simple form

We Review

Quote within 2 business days

Get Set Up

QuickBooks & portal access

Grow Together

Ongoing support & reports

Request Quote

We Review

Get Set Up

Grow Together

Frequently Asked Questions

Are your quotes free?

What information do you need for a quote?

Do you offer remote services?

What makes Phoenix different from other accounting firms?

What equine-specific deductions can you maximize?

How do I choose the right package?

Do I need QuickBooks?

What's included in the setup fee?

How quickly can you start?

What if I need more than the standard packages offer?

Ready to Partner with Equine Accounting Experts?

Whether you run a single-horse lesson program or a multi-state breeding operation, Phoenix Accounting has the expertise to keep your finances on track.

Serving equine professionals nationwide